Options Trading: A Comprehensive Guide to Understanding, Strategies, and Risks

Options trading is a powerful financial tool that offers traders and investors the ability to hedge, speculate, and enhance their portfolios. Despite its potential for high rewards, options trading also comes with significant risks, making it essential for traders to understand the mechanics, strategies, and market dynamics before entering the world of options. This article provides a thorough overview of options trading, explaining its fundamentals, key strategies, and how it works in the financial markets.

Table of Contents

- Introduction to Options Trading

- What Are Options?

- The Basics of Options Contracts

- Types of Options: Call and Put

- How Options Work

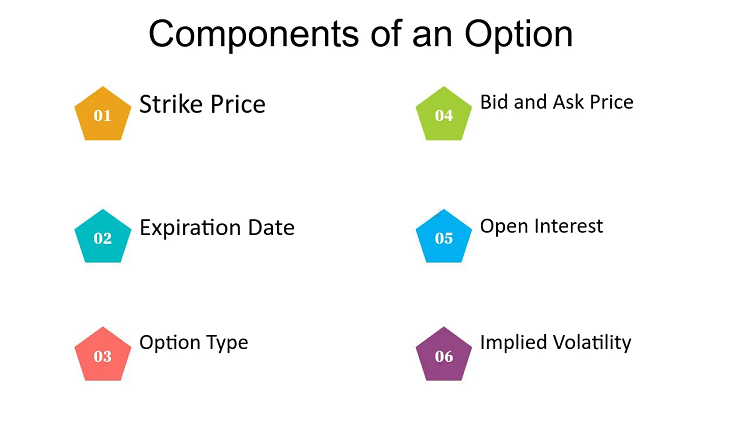

- The Components of an Option

- The Pricing of Options

- Types of Option Markets

- Popular Options Trading Strategies

- Advantages and Disadvantages of Options Trading

Introduction to Options Trading

Options trading is a financial practice that allows investors to buy and sell the right to buy or sell an underlying asset at a predetermined price within a specified time frame. Unlike stocks, where an investor buys ownership of a company, options offer a unique, flexible way to speculate on the price movement of an asset, such as stocks, commodities, or indices.

For many, options trading can seem complicated, but with the right knowledge, it can be a valuable addition to any investor’s toolkit. This article will guide you through the fundamental concepts of options trading, key strategies, and the risks involved.

What Are Options?

At its core, an option is a contract that gives the holder the right, but not the obligation, to buy or sell an underlying asset at a specified price (the strike price) before a certain expiration date.

There are two primary types of options: call options and put options.

- Call Option: A call option gives the holder the right to buy the underlying asset at a specific price before the expiration date.

- Put Option: A put option gives the holder the right to sell the underlying asset at a specific price before the expiration date.

While options are typically associated with stocks, they can also be applied to other assets like commodities, currencies, or indices.

The Basics of Options Contracts

An options contract is an agreement between two parties – the buyer and the seller (also known as the writer). The contract outlines the specific terms of the option, including:

| Component | Description |

|---|---|

| Underlying Asset | The asset on which the option is based (e.g., stocks, ETFs, commodities). |

| Strike Price | The price at which the holder can buy (for a call option) or sell (for a put option) the underlying asset. |

| Expiration Date | The date on which the option expires. If the option is not exercised by this date, it becomes worthless. |

| Premium | The price paid by the buyer to the seller for the option. |

| Contract Size | The number of shares or units of the underlying asset represented by the option contract. |

Types of Options: Call and Put

As mentioned earlier, there are two main types of options contracts: call options and put options. Each serves a different purpose and offers distinct opportunities for traders.

Call Options

A call option gives the holder the right to buy the underlying asset at the strike price before the expiration date. Call options are typically used when the trader believes the price of the underlying asset will rise.

- Profit Potential: Theoretically unlimited, as the price of the underlying asset can rise indefinitely.

- Risk: Limited to the premium paid for the option.

Put Options

A put option gives the holder the right to sell the underlying asset at the strike price before the expiration date. Put options are typically used when the trader believes the price of the underlying asset will fall.

- Profit Potential: Limited to the strike price minus the premium paid, as the price of the underlying asset cannot fall below zero.

- Risk: Limited to the premium paid for the option.

How Options Work

Options trading involves buying and selling the right to buy or sell an underlying asset. Let’s break down how options work:

- Buying an Option: When you buy an option, you pay a premium to the seller. In return, you have the right to exercise the option and buy or sell the underlying asset at the strike price before the expiration date.

- Exercising an Option: If the option is in-the-money (ITM), meaning the strike price is favorable compared to the current price of the underlying asset, the holder may choose to exercise the option and make a profit.

- Selling an Option: If you sell an option, you collect the premium paid by the buyer. In return, you have the obligation to buy or sell the underlying asset at the strike price if the option is exercised by the buyer.

In-the-Money (ITM), At-the-Money (ATM), and Out-of-the-Money (OTM) Options

- In-the-Money (ITM): For call options, this means the strike price is lower than the current market price of the underlying asset. For put options, this means the strike price is higher than the current market price.

- At-the-Money (ATM): The strike price and the current market price of the underlying asset are the same.

- Out-of-the-Money (OTM): For call options, this means the strike price is higher than the current market price of the underlying asset. For put options, this means the strike price is lower than the current market price.

The Components of an Option

Several factors influence the pricing and value of options, and understanding these components is crucial for successful options trading.

Key Components:

| Factor | Description |

|---|---|

| Intrinsic Value | The difference between the strike price and the current market price of the underlying asset, if favorable. |

| Time Value | The value attributed to the amount of time remaining until the option expires. The longer the time, the greater the time value. |

| Implied Volatility | The expected volatility of the underlying asset, which affects the option’s price. Higher volatility leads to higher option prices. |

| Delta | The rate of change in the option’s price relative to the change in the price of the underlying asset. |

| Gamma | The rate of change in delta relative to the change in the price of the underlying asset. |

| Theta | The rate at which an option’s price decays as it approaches expiration. |

The Pricing of Options

Options are priced using complex mathematical models, such as the Black-Scholes Model and the Binomial Option Pricing Model. These models take into account various factors, including the underlying asset’s price, the strike price, the time until expiration, interest rates, and implied volatility.

The Black-Scholes Model is one of the most widely used models in options pricing, particularly for European-style options.

Types of Option Markets

Options are traded in two main types of markets: exchange-traded options and over-the-counter (OTC) options.

Exchange-Traded Options

These options are listed and traded on formal exchanges like the Chicago Board Options Exchange (CBOE). They are standardized contracts with specific terms, making them liquid and highly regulated.

Over-the-Counter (OTC) Options

OTC options are customized contracts traded directly between two parties, typically in less liquid markets. These options can be tailored to fit specific needs but carry additional counterparty risk.

Popular Options Trading Strategies

There are numerous strategies in options trading, each with varying levels of risk and complexity. Some popular strategies include:

- Covered Call: Involves holding a long position in the underlying asset and selling call options on that asset. This strategy generates income through premiums but limits upside potential.

- Protective Put: Involves buying put options to protect against potential downside risk in a stock you already own.

- Straddle: Buying both a call and a put option on the same asset with the same strike price and expiration. This strategy profits from significant price movement in either direction.

- Iron Condor: A more complex strategy that involves selling an out-of-the-money call and put, while simultaneously buying a further out-of-the-money call and put. This strategy profits from low volatility.

Advantages and Disadvantages of Options Trading

Advantages

| Advantage | Description |

|---|---|

| Leverage | Options allow you to control a large amount of the underlying |